Sole Trader vs Limited the Tax Difference

Selecting the right business structure can be critical for many reasons, such as scalability, taxes, cost efficiency, protection, and growth among many other reasons. Making sure you select the right structure for the right reasons can result in being the key reason why your business succeeds or fails, this article looks at one aspect of this challenge.

What is a Sole Trader

An individual who is the sole owner of a business and is entitled to all the profit and all the risk of the business.

What is a Limited Company

A limited company is a separate entity in which all owners have their risk limited to their investment, the company owns all its income and assets. The owners in the company own the company through the purchase of shares.

Sole Trader Versus Limited Company: Tax Differences and Savings (2018/19)

This article looks at whether it’s beneficial to run your business as a company or as a self-employed sole trader from a tax point of view. It is always advisable to take advice from your tax accountant before making any significant decisions.

In 2018/19, what has changed for Sole traders?

Tax is going digital which should either make Accountants in London & their Business clients, either breathe a sigh of relief or get worried about what’s coming next.

- HMRC (Her Majesty’s Revenue and Customs) is moving ahead with Making Tax Digital (MTD) by initiating live pilot plans for VAT.

- Any sole traders who trade over the VAT threshold will be placed in MTD as of April 2019 for VAT only.

Trading and property allowances

- Two income tax allowances of £1,000 for a property, and for individuals who have minor trading income will be in effect from 6th April 2017.

- People who receive incomes that are less than the allowances mentioned above need not declare or pay tax on that particular income.

- In addition to the above point, people who receive incomes that are higher than this value can choose to deduct the allowance instead of claiming expenses.

Landlords

- Individual landlords can use fixed mileage rate deductions starting from April 2017.

- Rental income is affected by a cash basis.

In 2018/19, what has changed for SME company owners?

Businesses will find this bit of news interesting. The corporation tax rates have changed to 19% on 1st April 2017 and will further lower to 17% in 2020. You should question your Business Accountant on how this can add value to your business if using a company structure compared to a sole-trader structure.

OMB employment issues & IR35

The following is in effect from April 2017

- People working in the public sector have enjoyed a 5% tax-free IR35 allowance. This will be abolished.

- IR35 scenarios: the public sector body will take responsibility for assessing as well as paying employment taxes. They will seize control of this power from PSCs.

Dividends

6 April 2018 onwards the tax-free dividend allowance has been lowered to £2,000.

- All dividends which fall higher than this amount will be taxed at 7.5% which is the basic rate; 32.5% which is the higher rate; and 38.1% which is the additional rate.

Losses

The below data is relevant from April 2017 onwards

- All companies will be able to use losses in a more flexible way of moving forward. They will be allowed to set them against other income.

- Large companies will be restricted to offset profits with losses to 50%. Small companies will be allowed more flexibility on losses that happened after April 2017. These small companies will not be forced to follow the same 50% restriction on loss utilization as their big company counterparts.

Disincorporation

- There have been zero proposals to extend and replace the disincorporation relief which ended on 31st March 2018.

In 2018/19, here’s what has changed for all businesses

Businesses will be required to keep computerized records as well as online quarterly filing timetables for the following:

- VAT from April 2019.

- Sole traders and landlords with a turnover larger than £10,000 from April 2020 will be required to keep computerized records of their income tax as well as NICs.

- From April 2020 onwards, corporation as well as income tax and NICs concerning large partnerships

Profits from trading in and developing UK land

There was an exception for contracts that were entered into before 5th July 2016. That exception has been removed. What this means is that all profits which were recognized in accounts on and after the date 8th March 2017 will be subject to tax in the UK.

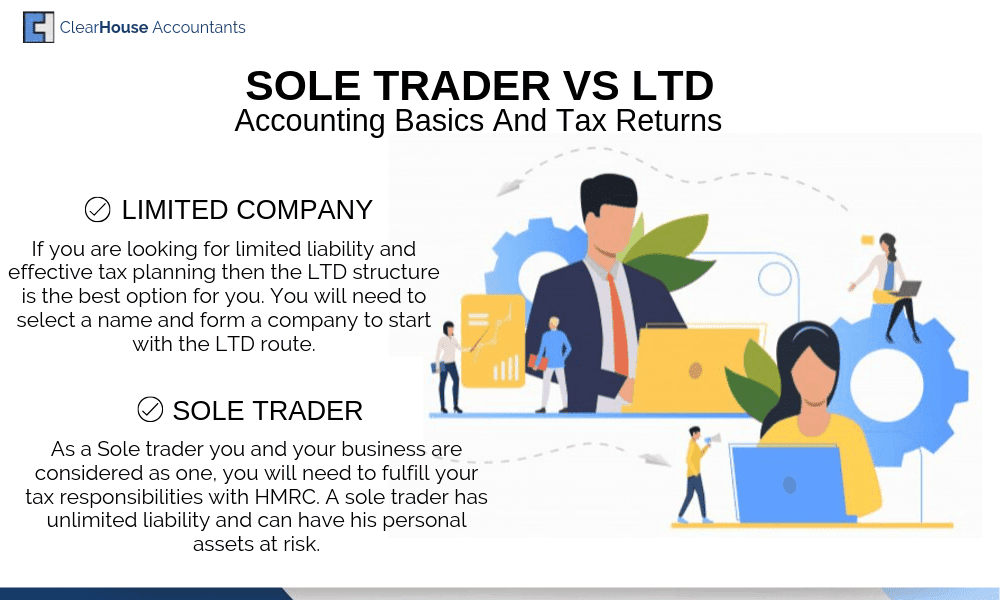

Critical differences between running a business as a Sole trader versus running a business as a Company

Private expenses and mixed-use of assets accounts must be adjusted for tax so that they don’t include items that aren’t wholly and exclusively incurred for apportioning as well as business taxes- if usage is mixed for tax.

SOLE TRADER |

LIMITED COMPANY |

|---|---|

| Accounting basis and tax returns Sole trader’ annual accounts are a simple affair to prepare. Unless cash accounting is used, all accounts must be prepared according to generally accepted accounting practices. (GAAP) |

Accounting basis and tax returns The Companies Act format, as well as the generally accepted accounting practice (GAAP), is used. The importance of using software to prepare accounts cannot be overstated. Companies should appoint an effective tax accountant to help them take care of compliance. |

| Making Tax Digital (MTD) There are four new quarterly returns that will follow year-end tax returns. They will accompany- · NICs as well as Income tax for Sole traders and landlords who have a turnover in excess |

Making Tax Digital (MTD) Limited companies also have four new quarterly returns which will be followed by year-end tax returns. They will accompany- · VAT from April 2019. · Corporation tax from April 2020. |

| Private expenses and mixed-use of assets Accounts must be adjusted for tax so that they don’t include items that aren’t wholly and exclusively incurred for apportioning as well as business taxes- if usage is mixed for tax. |

Private expenses and mixed-use of assets While limited companies do not need to adjust their accounts for usage of assets and private costs, they may still wish to do so for their owners to avoid a personal tax change. Personal tax accountants come highly recommended. |

| VAT VAT turnover can be verified by using invoices. However, this has the potential to be confusing if the sole trader is using a cash accounting scheme for income tax as well as NICs. |

VAT The Flat Rate Scheme should use limited cost trader rules. |

| Extracting profits It’s quite straightforward for sole traders. As they are the business, all the profits that they make are theirs alone after-tax and NICs are considered. |

Extracting profits It is understood that the company is a separate legal entity from its directors as well as its shareholders. As a result of this, all of the profits cannot be taken by the owner unless certain formalities are followed. |

| Loans Similar to the point about extracting profits, as you are the business, all profits extracted are yours alone no matter the situation. Loans cannot be made to yourself. |

Loans Companies can issue a loan to the owner of up to £10,000 without a taxable benefit. |

| The rate of tax: your business When income is more than £100,000, personal allowances are scaled back. |

The rate of tax: the company As already mentioned, the corporation tax has been lowered to 19% as of 1st April 2017. It will fall to 17% as of 1st April 2020. |

| Income splitting Sole traders can split their income by commencing business operations with a partner. |

Income splitting A spouse, partner, and family are eligible for company dividend income. |

| Rent Tax relief cannot be claimed on rent paid to yourself. |

Rent People who own properties may rent them to their companies. |

While this is far from a comprehensive list of differences between a sole trader and a limited company, the basics are covered in this article. Your Accountants, Business Accountants or Personal Tax Accountants should be familiar with all the differences and key points and should be able to guide you in using these strategies in the most efficient manner.

If you’re confused about taxes in the UK, consider scheduling an appointment with a good accountant in London as the rules of tax differs depending on the area in question. London accountants aren’t known for being cheap, however, they are known for doing their jobs right as well as to a high standard.

If you are just starting up, a good start-up accountant will make sure you select the best business structure when forming your business. Startup Accountants keep you on the right side of HMRC and make sure you are prepared and a few steps ahead of changing legislation and complicated compliance requirements.

Clear House Accountants are specialist Accountants in London, with their team of Personal Tax Accountants they help businesses create smart solutions for their business and tax needs to make sure they are effectively and efficiently saving money and growing their business. The data in this article is for information only, please seek professional advice before making any major tax or accounting decisions.

Difference between Sole Trader & Limited Company?

A sole trader is a business owner who is considered the same as his business, he is taxable on all his business profits and retains all the risks for his business personally. A Limited Company is a separate entity to the owners of the business, the profits belong to the company and can be extracted by owners utilizing different methods and strategies.

Does LTD give me limited liability?

A limited company limits the liability of a business owner to the investment they have made in the business.

Are Freelancers Sole Trader?

Freelancers are normally sole traders, you can work as a freelancer through a company as well.

You might also want to read:

Forming A Partnership – Limited OR Unlimited?

Contractors Options- Umbrella VS Limited Company

Obligations As A Sole Trader (Infographics)

The post Sole Trader vs Ltd- The Tax Differences appeared first on Tweak Your Biz.

source https://tweakyourbiz.com/business/accountancy/sole-trader-ltd

No comments:

Post a Comment