There are a lot of articles out there about Digital Banking trends, but few of these trends become must-haves for digital banking and fintech projects. So, in this text, we are going to provide insights into the most promising changes in banking software development.

In addition, we are going to touch upon such topics as cost estimates and approximate timeframe for the development of digital banking projects.

At the end of the article, we added a list of key takeaways to look through.

Some background to prove our expertise: the Qulix Systems Company is focused on banking software development, integration and implementation for over a decade. Besides, we have our own software products, but that is a whole different story. Here we are talking about custom development for banking, not readymade software.

What we noticed is that large banks and FinTech companies we partner with are willing to build up their own technical expertise and engage in co-development of their own platform.

We are the vendors, who are ready to assist in such projects, as we have the necessary experience and human resources, gather statistics and are aware of the major pros and cons of Digital Banking trends.

By the way, the meaning of ‘Digital Banking’ in business partners can vary a lot. Digital Banking is more than a brand-new mobile banking app, or a global innovative platform, and even more than a single project.

Digital Banking is a set of activities and projects lasting for numerous years. Bank top managers should be aware of the investment required for a digital transformation and its support, as it is quite costly and ambitious.

Decision

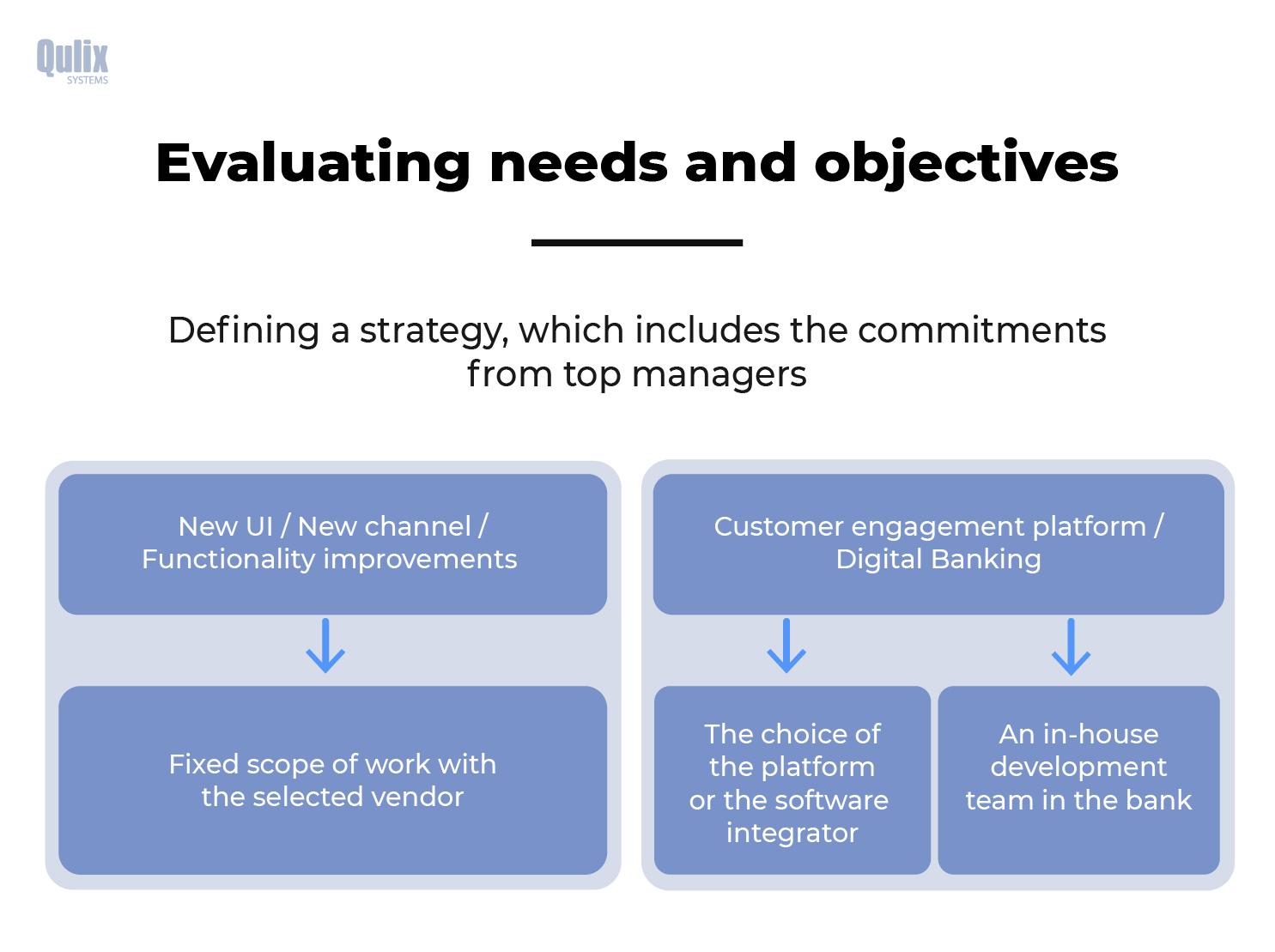

The picture illustrates the decision-making process. There are 2 approaches according to the bank objectives:

1) The objectives are: to update mobile and online banking systems, redesign their interface and add a couple of new features.

A chunk of such tasks is not ‘a digital banking project’. Besides, there is no need to overpay, when the bank doesn’t require radical changes. There are a lot of vendors out there able to implement basic adjustments and improvements at a reasonable price.

2) The objectives are: to build a bank’s own technical team (developers, analysts, UI/UX designers, etc.), to develop and support a full-fledged digital banking environment.

For this, it is necessary to create a digital hub in a bank by hiring a team and training it. In addition, banks have to choose between multiple banking platforms from various vendors and define the development strategies for their digital channels. Some banks hire mobile developers and engage in co-development with the vendor – nowadays is a major digital banking trend.

Fundamentals in Digital Banking trends

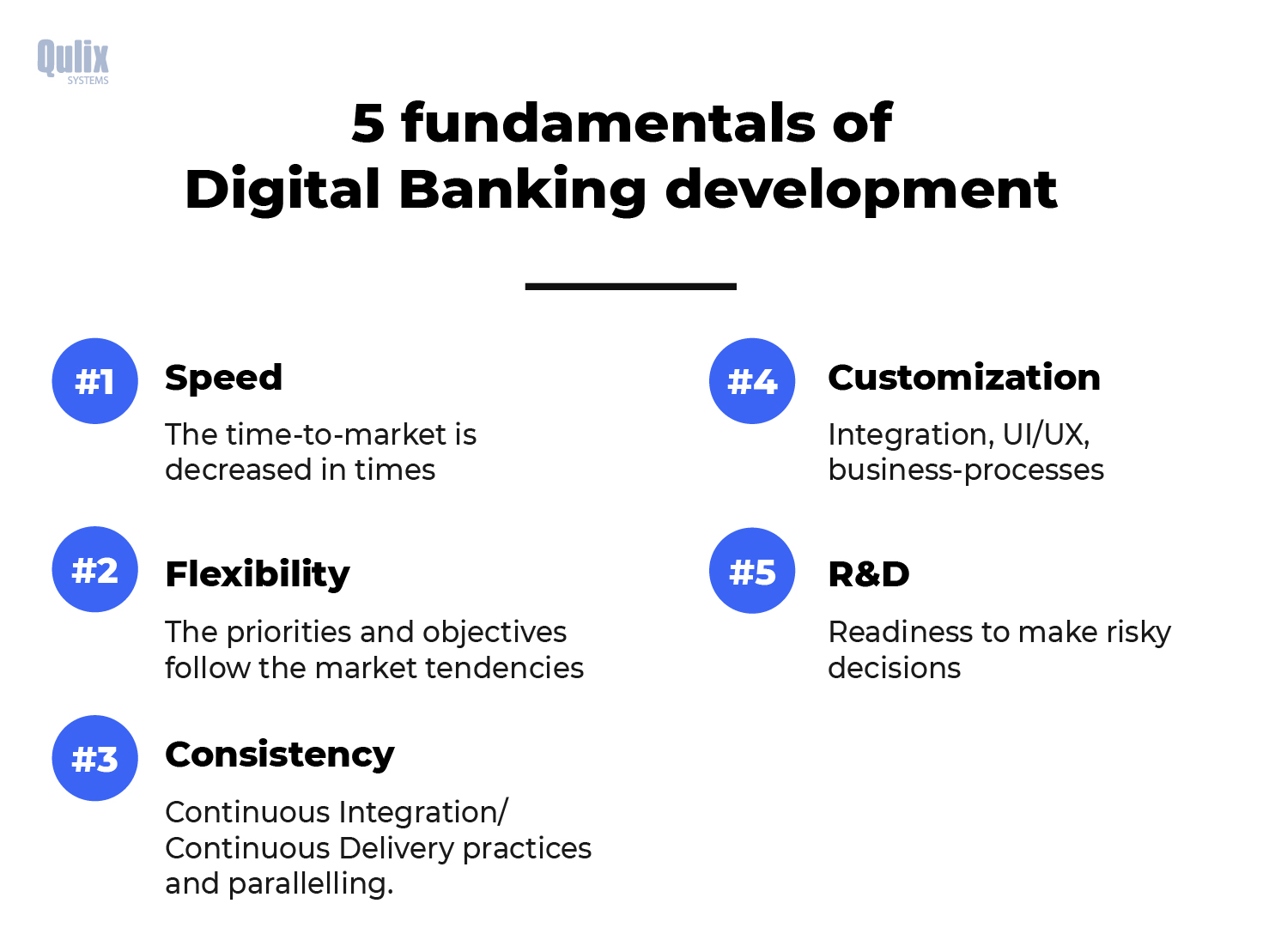

The decisive factor in choosing a digital banking platform lies beyond functionality. The key factors are the banking platform conformity with non-functional requirements and enough resources for project implementation.

As the financial service market is excessively dynamic, rapid feature delivery is a must. Development iterations lasting for 3 or even 6 months are long gone. If the bank is focused on entering the digital market or dominating it, the product deployment and production servers should be carried out in no time after each iteration. New software builds should be released within a timeframe of 1-2 weeks, because one month is too long. Choosing the optimal release schedule and adapting the processes usually require some time.

Being flexible is not the same as making spontaneous decisions. Digital banking development requires a roadmap, which outlines channels, planned features and the timeframe of their implementation. However, it is okay that within 3 months the priorities may shift – and that’s all about being flexible.

Customization of digital financial products is more than a good practice or a bon ton, it’s a necessity in the situation of tough market competition. From our experience, banks hire digital agencies to build UI/UX design and hire an integrator (a development company) afterward, and we, in turn, build the final product version.

Digital banking is no doubt a risky initiative. On one hand, there are several aspects, the effectiveness of which should be thoroughly considered. On the other hand, it is impossible to predict the outcome success of the idea prior to investing in it. For banks, a decision to take a risk may be quite tough.

What’s more, bank stakeholders may seem disappointed that software vendors don’t take enough initiative. Quite on the contrary: we often offer digital onboarding or app gamification ideas.

However, it’s out of the vendor’s scope of work to prove that ideas or features are economically sound.

It’s excellent when banks and fintech companies have R&D budgets on building prototypes and evaluating their performance live: on the real market and users. It is more than a digital banking trend, but a powerful competitive advantage.

Banks must be assured that they have realistic expectations about the size of their in-house development team and required investment.

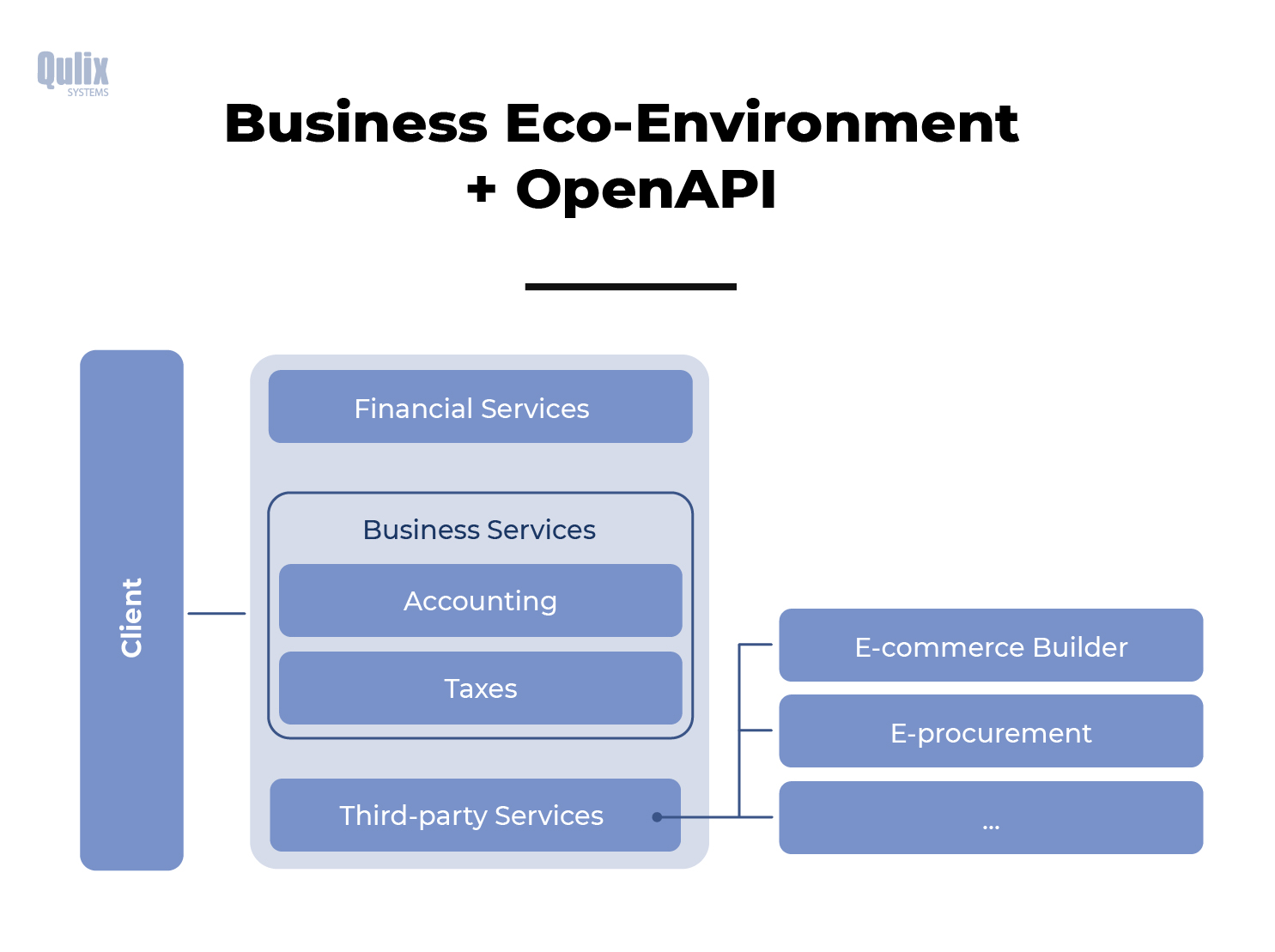

In other words: there are multiple financial services popping up on the market. Banks cannot integrate these services with no third-party assistance. The trend is obvious: internal bank systems should be prepared for flexible integration with fintech, insurance, and other services. For example, customers want to book tickets and call a taxi right from your app. About half of our business partners accentuate the need for third-party service integration for their RBS. Indeed, building a thriving ecosystem is a must for ambitious banks.

Team and Сosts

Before discussing the costs, let us mention the advantages of the T&M cooperation model. The budgeting issues in banks can set notable restraints on the roadmap implementation and delivery time. Vendors can feel your pain from planning yearly budgets and restrictions on their use. However, we are still persuading our banking and fintech partners to switch to the flexible payment model to accelerate the project.

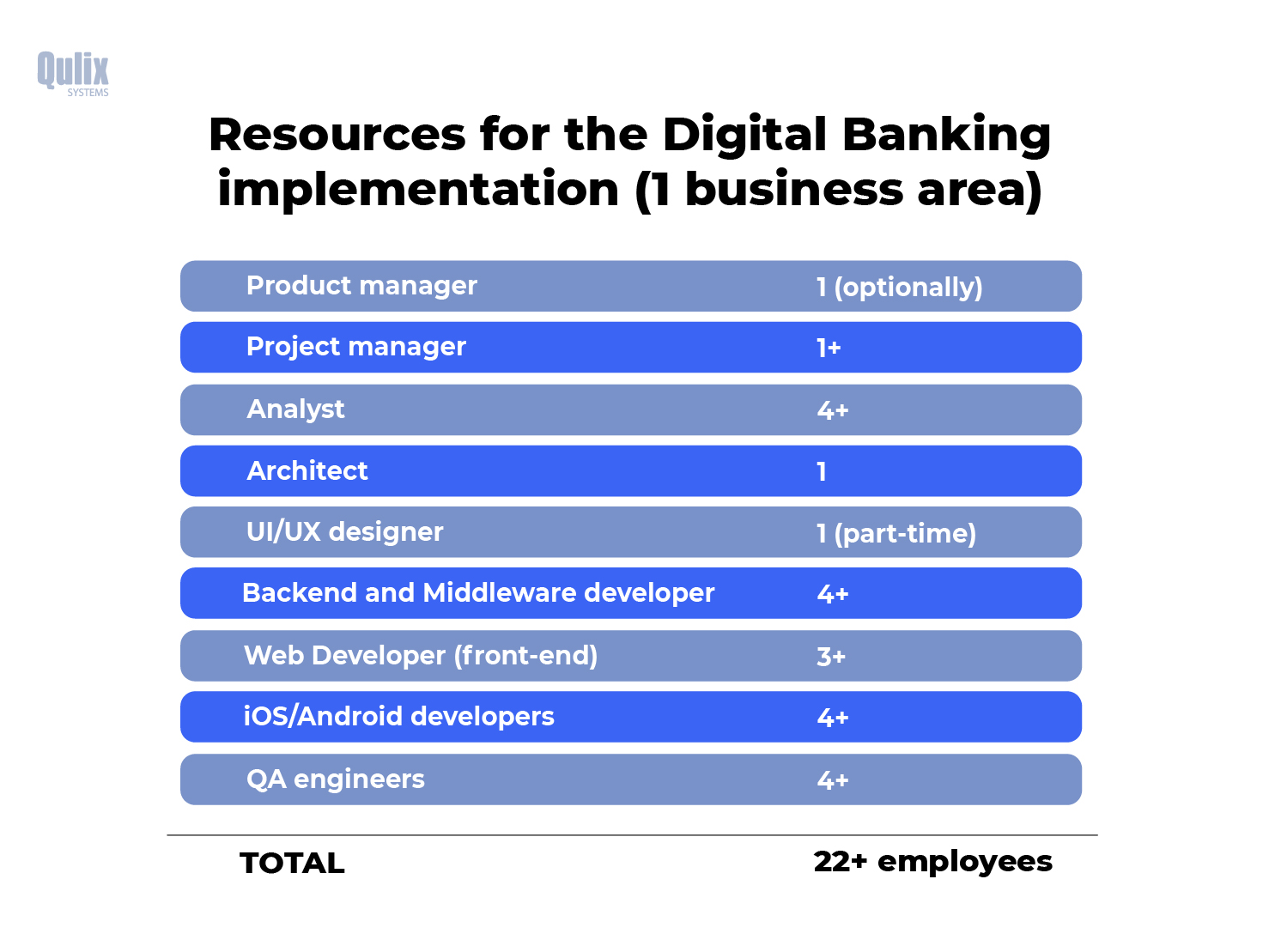

As we discuss the team, let’s consider its minimum size necessary for the Digital Banking implementation in one of the following areas: retail, corporate, SMBs, or front-office. Keep in mind, if the bank is going to digitalize all of these, the human resources estimate we provide below can be tripled.

A Product Manager is a bank employee, who is responsible for creating a roadmap and prioritizing the features. The position is optional.

A Project Manager is a must-have. Primarily, vendors are engineers and may not be aware of certain business domain peculiarities. This is why a good project manager plays a decisive role. It’s even better when there are a few of them.

To deal with analytics the proper way, we suggest hiring at least 4 analysts, especially for the retail area.

Hiring an architect for Digital Banking is highly recommended. As a rule, banking software has complicated back-end structures, and there should be someone to deal with them.

It is followed by the necessity of an experienced team of backend and middleware developers. Add front-end developers and 4 mobile developers for each platform (a minimum of 2 per platform). A team of 4 QA engineers is a required minimum: there are lots of mobile devices and updates.

To conclude, we get a minimum team size of 22 specialists.

The cost of hiring a dedicated developer is approximately $5K/month. Therefore, the monthly team expenses exceed $100K.

As one year may appear not enough for a large-scale project, the Digital Banking development for each area (retail, corporate, and etc.) has a total cost of over $1M. This way a $2-3M investment is required to cover them all.

If the objective is to win leadership on the banking market, this kind of investment makes absolute sense. Keep in mind that such estimates don’t include internal hardware costs, licenses, expenses on the bank staff, and others.

Key takeaways:

- Large banks and FinTech companies strive for building up their own technical expertise and engaging in co-development of their own platform.

- Digital Banking is more than a single project. It is a set of activities and projects, which may last for a couple of years.

- There is no need to overpay when the bank doesn’t require radical changes. Basic adjustments and improvements can be implemented at a reasonable price.

- However, if the bank is interesting in developing and supporting a full-fledged digital banking environment, it requires having a digital hub (hiring and training an in-house technical team).

- Nice-to-have transforming into fundamentals: speed, flexibility, regular delivery, customization, R&D.

- Time & Material cooperation model offers more benefits.

- Minimum team size for Digital Banking development (1 business area) is 22 full-time employees.

- The required yearly investment is $1-3M depending on the number of business areas to cover.

The post The Transformation of Digital Banking Trends and Nice-To-Haves into Essentials appeared first on Tweak Your Biz.

source https://tweakyourbiz.com/technology/trends/digital-banking-transformation

No comments:

Post a Comment