The Construction Industry Scheme (CIS)

The UK’s Construction Industry Scheme, abbreviated as CIS, is a national tax-deduction scheme for British contractors and sub-contractors. Created to reduce tax evasion in the construction industry, the scheme falls under the jurisdiction of and reports to Her Majesty’s Revenue and Customs (HMRC).

Any New Developments?

As of 5th September 2018, a non-resident firm engaging in construction activities falling under CIS can register online either as a contractor or a sub-contractor. Beginning July 2016, the law requires that all non-resident persons, trusts, partnerships, and/or companies trading in, dealing in or developing land within the borders of the UK register either for income or corporation tax.

Further, as from 6th April 2019, the currently-existing security deposits’ legal regime for the pay-as-you-earn (PAYE) tax takes into account CIS deductions. The Finance Act 2019 empowers HMRC to demand details of securities from any business entity it considers a high-risk enterprise: If an HMRC officer has a valid reason to believe this is crucial for the safeguarding of the country’s revenue.

Failing to act in accordance with an HMRC officer’s request for securities details will be considered a criminal misdemeanour liable to legal penalties. It has been proposed that as from April 2020, CIS taxes will form part of the deductions that will be considered a secondary preferential creditor in case a business becomes insolvent.

It is always a good decision to hire a competent contractor accountant to keep you updated with all the regulatory and compliance changes.

Overview and Examples

CIS regulations are also designed to cover any payments a contractor makes to their sub-contractor(s) under a legal construction contract, with foreign-controlled firms operating in the UK also included.

What is Construction for CIS?

CIS rules generally define construction as building, making, assembling or putting together, and its activities may include:

Groundworks and preparation of site;

General building works like bricklaying, plastering, and roofing;

Electrical works and plumbing;

Painting and decoration works;

Maintenance and general repairs;

Demolition and dismantling works;

Erecting scaffolding structures;

Extending an existing building structure;

Landscaping and tree planting when done as part of a new housing development project;

Assembling of pre-fabricated housing units either on- or off-site and site facilities;

Assembling of parts of a prefabricated housing structure that is then transferred to a different site for final installation.

Construction activities exclude architects, surveyors and/or building inspectors. Sometimes identification can get tricky having the expertise of qualified contractor accountants can help make the process easier.

What are Contractors for CIS

These are commercial enterprises involved in the construction business that also pay subcontractors to perform the actual construction work.

UK law allows any legal business type (including companies, sole traders and partnerships) to be contractors. Which can include property developers, builders, and even labor agencies? A commercial enterprise that isn’t involved in the construction business may be deemed to be a contractor if it spends 1 million or more on construction work within a 3-year period. Such could include UK-registered or UK-operating housing associations.

– Exemptions to this statute include where rules have been violated due to any kind of construction works on properties that are used in the business.

– Any property that’s let out, put up for sale or otherwise held for purposes of investment isn’t considered to be used in that particular business as far as this exemption is concerned.

– Certain kinds of incidental use of the particular property for non-business use could be allowed by law.

If you are unsure about where to start or how to form a company, you need to speak to a qualified accountant in London who should be able to help you with the setup and running of your contractor or sub-contractor firm.

Registration

Before a contractor can qualify to pay any sub-contractor, they must first register with HMRC. An online service exists for this purpose and the process of registration takes approximately 2 weeks. Even after registration, a contractor must still ensure the following before they can make any payment to a sub-contractor:

Confirm that the sub-contractor they’re dealing with has registered for self-employed as their current employment status.

If the particular sub-contractor in question is an employee of any organization, then the CIS scheme rules don’t apply to them and they’re paid via their payroll under PAYE regulations.

If a sub-contractor wasn’t included in the per-month CIS return by the contractor during the current tax year or one of the past 2 tax years, then the contractor is legally obliged to verify their details with HMRC so that an HMRC officer confirms the latest rate of deduction that needs to be applied. An online verification service exists for this purpose.

If a sub-contractor doesn’t need to go through the verification process stipulated above, then the contractor may apply the rate of deduction that they used previously when paying the sub-contractor.

Accountants that specialize in working with contractors, subcontractors, and CIS are experts at offering registration and filling services to them across the UK. The services contractor accountants cover will provide you with the peace of mind that will help you to focus on growing and refining the services you provide.

The Verification Process

Things to keep in mind by contractors, when you’re verifying a certain sub-contractor:

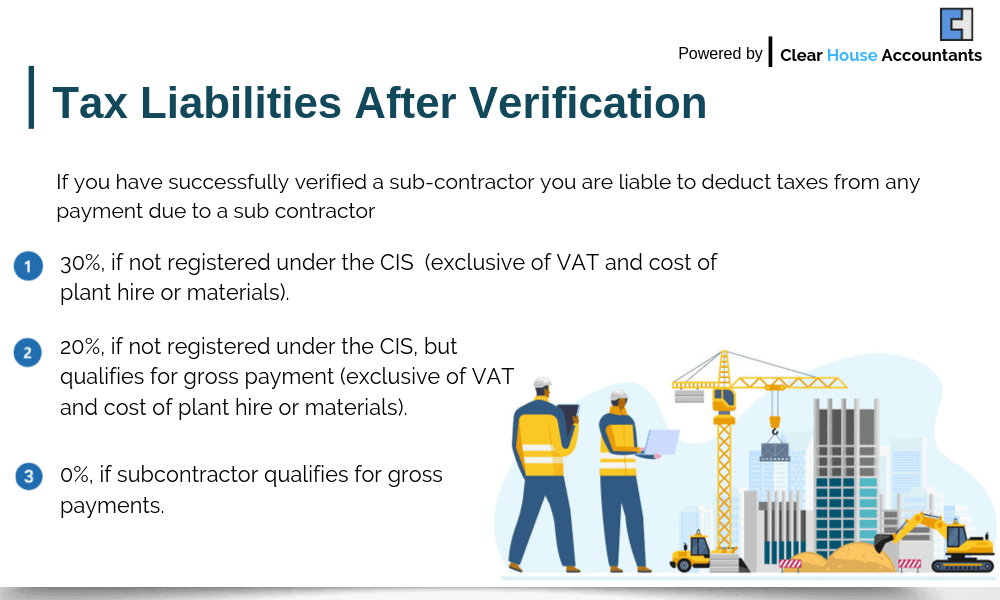

Make sure you have their full name correctly recorded and not abbreviations. If, for instance, you’re verifying a firm whose registration details indicate Ltd, then don’t change it to Limited, and vice versa. If the verification system returns unknown results, check again that you’ve entered the correct details. After successfully verifying a sub-contractor, the contractor is required by law to deduct as follows all taxes at the source from any payment due to a sub-contractor:

- 30% from sub-contractors who aren’t registered under the CIS scheme, excluding the equivalent of VAT as well as the cost of plant hire or materials.

- 20% from sub-contractors who aren’t registered under CIS but qualifying to get gross payments, excluding the equivalent of VAT as well as the cost of plant hire or materials.

- Zero deductions if a sub-contractor qualifies to get gross payments.

For any deductions made, the contractor is obliged to provide a PDS (Payment Deduction Statement) to the sub-contractor within 14 days from the last day of the current tax month.

A sub-contractor may request to be supplied with a duplicate copy of a lost or otherwise mislaid PDS document. The contractor is obliged to provide it, albeit clearly labeled as duplicate.

After duly paying and issuing sub-contractors with their respective PDS statement, a contractor will still be required by HMRC regulations to ensure the following:

CIS deductions are remitted to HMRC just like PAYE deductions; A single payment is made monthly, or quarterly, under deductions meant for PAYE, CIS, and National Insurance schemes.

The payment’s due date is either the 19th day of the month if filing manually, or the 22nd if the electronic mode of payment is used.

A CIS return filing must be done with HMRC every month, with the filing finished by the 19th day of the month. Beginning in April 2016, all filing must be performed online, prior to which one could also file using the paper return method (CIS300). Even if you never had any sub-contractors to pay during the period under review, you must still file a nil return.

If you are not too sure about how the CIS scheme works, it is recommended to find a good contractor accountant, someone who can help you complete all the necessary filing on time while saving tax and time.

– In case you aren’t expecting to have any sub-contractors underpayment for a particular time period, then you should check the Inactivity Request box on the per-month return. This will notify your HMRC office that you’re not paying any sub-contractors for up to a period of 6 months.

As a contractor, you need to notify HMRC of such business changes as:

– Change of address whether for an individual or a business;

– Change of business structure;

– Temporary cessation from using sub-contractors.

Penalties and fines apply for late filing.

A single commercial entity is allowed by law to act as both a contractor and a sub-contractor. Such a business will be obliged to separately register as both.

Speak to your Contractor Accountant to make sure all relevant filings, deductions, and verifications are being made if you are a contractor employing sub-contractors.

Sub-contractors – Any subcontractor that fails to register with HMRC will have up to 30% tax deductions hived off their payments by their contractor. This rate goes down to 20% if the subcontractor is registered with HMRC, and further to nil if they meet the eligibility conditions for gross payments. A sub-contractor will qualify for gross payment status registration if they pass the following 3 eligibility tests:

Business test: They must be conducting business in the UK and doing this largely through a legal bank account.

Turnover test: If an individual or sole trader is involved, they need to have an annual turnover of 30,000 or higher, excluding VAT and the cost of materials. As for companies and partnerships, the turnover per partner/director per year must be 30,000 or higher, or over 200,000 if this amount is less.

Compliance test: No unsettled payments due to HMRC or tax returns should be there. While HMRC often ignores some minor compliance issues, having more than one failure reported could revoke your gross payment status (which is reviewed once per year). Sub-contractors are required by HMRC regulations to report any business changes, including:

Change of business type, private or registered address;

Change of your trading name;

Altering of business structure (for which a fresh gross payment status evaluation needs to be applied);

Addition of any new shareholders (for companies);

Termination of core trade.

A contractor accountant will help you keep ahead of such complicated compliance requirements, claim the overpaid CIS and make sure you are paying the minimum possible amount.

Payment of Taxes and Reclaiming of Any Overpayments

Sole traders and/or partners can pay or reclaim any under- or over-deductions to the CIS via self-assessment.

For companies, any such deductions must be included as part of their EPS (Employer Payment Summary) information. Any overpayments will be used as a relief to PAYE and any NIC payments due. If your company’s PAYE and NIC annual bill isn’t enough to absorb all the CIS over-deductions, then you can claim for repayment through writing to HMRC once the tax year is over.

Businesses which are not resident in the UK

The CIS scheme will apply to a non-resident if:

- It is a contractor who has the responsibility of paying a subcontractor for work they have carried out on projects in the UK

- It is a subcontractor who is being paid for work that is being carried out in the UK

The location of where the payment is made is irrelevant as long as the construction work is being carried out in the UK. If such is the case the CIS scheme will apply.

There is no difference in the application of the CIS scheme for a resident or non-resident contractor or subcontractor.

The post Understanding the Construction Industry Scheme – CIS appeared first on Tweak Your Biz.

source https://tweakyourbiz.com/business/accountancy/construction-industry-scheme

No comments:

Post a Comment